In an increasingly globalized world, finding a reliable currency exchange provider in Canada is more essential than ever. Whether you’re traveling abroad, conducting international business, or sending money to family overseas, understanding how to choose the right exchange services can save you substantial funds and avoid unnecessary hassles. The significance of a trustworthy currency exchange provider extends well beyond simple transactions; it involves securing your hard-earned money and ensuring that you receive the best rates available.

Take a moment to consider Jenna, a frequent traveler who struggled with hidden fees and fluctuating rates in the past. After switching to a reliable currency exchange provider in Canada, she not only received a better exchange rate but also felt confident knowing her money was in safe hands. This personal experience underscores the importance of conducting thorough research to identify providers that prioritize transparency, efficiency, and customer service.

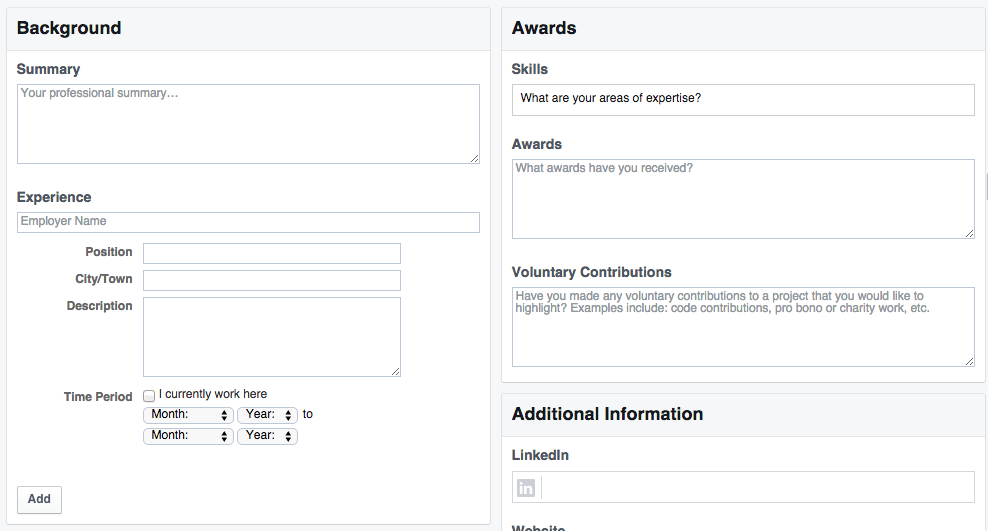

Here are some key factors to consider when selecting a reliable currency exchange provider in Canada:

- Exchange Rates: Always compare rates between providers to find the best deal.

- Fees and Charges: Look for hidden fees that might eat into your savings.

- Reputation: Read reviews and testimonials from previous customers.

- Convenience: Consider the accessibility of services, like online options or physical locations.

Frequently asked questions often revolve around understanding how exchange rates are determined and how to mitigate risks associated with currency conversion. By engaging with a reliable currency exchange provider in Canada, you can ensure not only competitive prices but also gain valuable insights into managing your exchanges effectively.

In summary, making an informed choice about your currency exchange provider can lead to significant financial advantages. Whether you’re a frequent traveler like Jenna or looking to conduct business on an international scale, understanding what makes a reliable currency exchange provider in Canada can have lasting impacts on your financial success.

Overcoming Challenges of Reliable Currency Exchange Provider Canada

Finding a reliable currency exchange provider in Canada can be a daunting task for both residents and travelers. One of the primary challenges is ensuring that the exchange rates offered are competitive and transparent. Many consumers have experienced the frustration of discovering hidden fees or unfavorable rates after the transaction is complete. For example, a friend of mine recently exchanged Canadian dollars for Euros before a trip to Europe. She assumed she was getting a good deal, only to find out later that the provider’s markup was significantly higher than advertised, leading to a loss of funds.

Another challenge lies in the varied levels of customer service across different providers. Some establishments may lack the necessary knowledge or resources to assist clients effectively. A case in point involves a business owner looking to exchange currency for international transactions. When she approached a local provider, she faced a long wait time and unhelpful staff, which not only prolonged the process but added to her stress. This experience can deter customers from using certain services, making it essential for exchange providers to prioritize training and efficient practices.

To overcome these challenges, consumers should prioritize researching providers online or through word-of-mouth recommendations. Websites that aggregate customer reviews can be invaluable in selecting a reliable currency exchange provider in Canada. Additionally, comparing rates across multiple platforms before committing to a transaction can ensure customers find the best deal available. Some steps to take include: checking online exchange platforms for real-time rates, ensuring the provider is transparent about fees, and considering established financial institutions with a track record of reliability. By taking these steps, individuals can navigate the complexities of currency exchange and find a provider that meets their needs with confidence.

Solving Problems of Reliable Currency Exchange Provider Canada

When it comes to establishing a reliable currency exchange provider in Canada, various challenges often arise, including fluctuating rates, regulatory complexities, and competition from international services. However, numerous innovative strategies can help tackle these issues effectively. First and foremost, leveraging technology is Our Currency Exchange History essential. A currency exchange provider can implement automated systems that monitor real-time exchange rates. This tool can provide clients with immediate quotations and help them secure better rates during specific market conditions.

Moreover, fostering partnerships with local businesses can significantly expand a provider’s reach and customer base. By collaborating with Canadian travel agencies or financial institutions, a currency exchange provider can create exclusive offers or loyalty programs that benefit both parties. For instance, one successful case involved a currency exchange service that partnered with a popular hotel chain, offering guests preferential rates. This partnership not only increased foot traffic to the exchange provider but also enhanced customer satisfaction through convenience and savings.

Another vital aspect of building a reliable currency exchange service is educating customers about the currency exchange process. Providing workshops or informational sessions can demystify the complexities involved in currency conversion and help clients make informed decisions. This not only fosters trust but also positions the provider as an industry expert. Personalizing communication through newsletters or targeted emails can ensure customers are always informed about the best times to trade, further enhancing customer loyalty.

In conclusion, a successful currency exchange provider in Canada must blend technology, strategic partnerships, and customer education to overcome the inherent challenges of the industry. By implementing these practical solutions, providers can create a robust and reliable service that meets the evolving needs of their clientele while standing out in a competitive market.

Conclusion: Finding a Trusted Currency Exchange Provider in Canada

In the ever-evolving landscape of international finance, the significance of choosing a reliable currency exchange provider in Canada cannot be overstated. A dependable provider not only ensures fair rates and transparency but also safeguards your financial transactions against unforeseen pitfalls. With a plethora of options available, individuals and businesses alike must critically assess factors such as market reputation, customer service, and technological adaptability.

As we navigate through the intricacies of currency exchange, it’s essential to approach the selection process with a discerning eye. Hope lies in the availability of numerous trustworthy providers dedicated to offering transparent and competitive rates catering to diverse needs. However, critical insight underscores the importance of due diligence—researching user reviews, understanding fee structures, and recognizing the potential impact of fluctuating exchange rates.

In conclusion, a smart choice of a reliable currency exchange provider in Canada can lead to significant financial benefits in the long run. As you embark on your journey through the world of currency exchange, let this guide serve as a reminder to prioritize security and integrity in every transaction, ensuring that your financial well-being remains at the forefront.

| Challenges | Solutions |

|---|---|

| Exchange rate volatility | Utilize hedging strategies to minimize risk |

| Regulatory compliance | Engage legal experts for compliance management |

| Fraud prevention | Implement robust security protocols and authentication measures |

| Limited access to global markets | Partner with international banks and financial institutions |

| Customer service challenges | Enhance training programs for customer support teams |

| Technological barriers | Invest in advanced currency exchange platforms |

| High transaction fees | Negotiate better rates with financial partners |

| Poor transparency in exchange practices | Adopt clear communication and reporting systems |

| Exchange service accessibility | Create mobile applications for easier access |

| Market competition | Differentiate services through unique value propositions |

| Economic fluctuations | Adjust strategies based on economic forecasts |

| Customer trust issues | Build a strong brand presence and reputation |

| Cultural differences in customer base | Offer localized services and multilingual support |

| Integration of payment systems | Use APIs for seamless payment solutions |

Reliable currency exchange provider Canada